virtual smart card for banking and payments Virtual cards are a digital-only type of credit card businesses can use to quickly pay vendors, employees and other entities and easily manage their expenses. NFC Cards NXP MIFARE Classic® 1k. €1.35. Reference 0501600600. Smart Cards in PVC, .

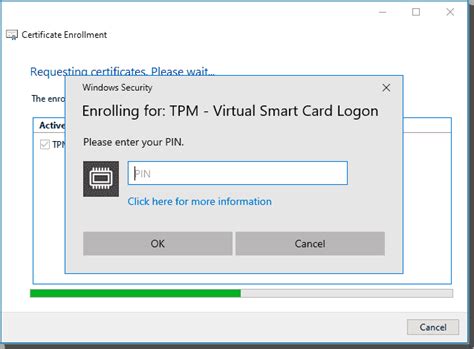

0 · virtual smart card windows 11

1 · virtual smart card windows 10

2 · virtual smart card download

3 · smart card log in

4 · smart card authentication step by

5 · microsoft virtual smart card

6 · braven smart card login

7 · 2fa virtual smart card

Aadhaar enabled Public Distribution System - AePDS Food, Civil Supplies and Consumer Affairs Department Government of NCT of Delhi

Virtual cards are a digital-only type of credit card businesses can use to quickly pay vendors, employees and other entities and easily manage their expenses.Virtual cards, which include rich payment data, can improve cash flow on both sides of the .

Virtual cards are a digital-only type of credit card businesses can use to quickly pay vendors, employees and other entities and easily manage their expenses.Virtual cards, which include rich payment data, can improve cash flow on both sides of the transaction, because they offer faster payment and simpler reconciliation by connecting orders, invoices and status of payments. That, in turn, can strengthen relationships between buyers . Virtual cards give businesses more control over their spending by allowing payments without exposing primary card information. Businesses can customize spending limits and expiration dates for each virtual card, giving them greater financial flexibility.A virtual credit card is a digital representation of your physical credit card, which may offer a secure and convenient payment method for online transactions. With compelling features like single-use transactions and tokenization, a virtual credit card can offer peace of mind when making purchases online. You can use a virtual credit card in .

What is a virtual card? What is a temporary card? Pros and cons of virtual credit cards; How do I request a virtual card? Is a virtual card different from a digital wallet?

Generating a virtual card from Capital One can give you the opportunity to make purchases without having your physical card on hand, easily set up recurring payments for your favorite subscription services and continue earning rewards or cash back on your purchases as you normally would. Virtual Card. Streamline accounts payable payment processing. Further digitize and monetize your accounts payable by integrating card payments seamlessly. Use one-time, single-purpose cards to pay specific suppliers a specific amount with a specific expiration date—which can reduce fraud to nearly 0%* and maximize your working capital.

Virtual cards, unlike physical cards, are digitally generated credit card numbers designed for specific transactions. They offer the same convenience as regular credit cards for online or over-the-phone payments and can even be added to digital wallets to be used at payment terminals.

Virtual cards work exactly like your physical bank card — they just live in your digital wallet on your phone instead of your physical wallet. Secured by encryption, they offer a safe and convenient way to pay online and in-store. Open bank account. The difference between virtual, digital and disposable cards.

A virtual credit card is a digital, one-time card number that differs from the number on your credit card and can help protect your account from fraudsters. Virtual credit cards often are used for online purchases. Virtual cards are a digital-only type of credit card businesses can use to quickly pay vendors, employees and other entities and easily manage their expenses.

Virtual cards, which include rich payment data, can improve cash flow on both sides of the transaction, because they offer faster payment and simpler reconciliation by connecting orders, invoices and status of payments. That, in turn, can strengthen relationships between buyers . Virtual cards give businesses more control over their spending by allowing payments without exposing primary card information. Businesses can customize spending limits and expiration dates for each virtual card, giving them greater financial flexibility.

A virtual credit card is a digital representation of your physical credit card, which may offer a secure and convenient payment method for online transactions. With compelling features like single-use transactions and tokenization, a virtual credit card can offer peace of mind when making purchases online. You can use a virtual credit card in . What is a virtual card? What is a temporary card? Pros and cons of virtual credit cards; How do I request a virtual card? Is a virtual card different from a digital wallet?

Generating a virtual card from Capital One can give you the opportunity to make purchases without having your physical card on hand, easily set up recurring payments for your favorite subscription services and continue earning rewards or cash back on your purchases as you normally would. Virtual Card. Streamline accounts payable payment processing. Further digitize and monetize your accounts payable by integrating card payments seamlessly. Use one-time, single-purpose cards to pay specific suppliers a specific amount with a specific expiration date—which can reduce fraud to nearly 0%* and maximize your working capital.Virtual cards, unlike physical cards, are digitally generated credit card numbers designed for specific transactions. They offer the same convenience as regular credit cards for online or over-the-phone payments and can even be added to digital wallets to be used at payment terminals.

Virtual cards work exactly like your physical bank card — they just live in your digital wallet on your phone instead of your physical wallet. Secured by encryption, they offer a safe and convenient way to pay online and in-store. Open bank account. The difference between virtual, digital and disposable cards.

virtual smart card windows 11

virtual smart card windows 10

Android users, SmarTrip for Google Wallet is here, making it possible to use your phone to pay, anywhere SmarTrip is accepted - for the train, on a bus or at a Metro-owned parking lot. Add a new SmarTrip card in Google Wallet, then .This lets you use the card without unlocking your phone. You just put it up to the reader and it accesses the SmarTrip card while still locked. With iPhone XR/XS or newer, when your phone’s battery dies, it can use the little bit of power still in the battery to use tokens saved as an .

virtual smart card for banking and payments|braven smart card login