contactless payment limit lloyds a credit card What is the contactless payment limit? The current contactless limit in the UK is .

NFC (Near Field Communication) technology is widely used for various purposes, such as contactless payments, data transfer between devices, and accessing information from .

0 · lloyds contactless payment limit uk

1 · lloyds contactless payment limit

2 · lloyds contactless not working

3 · lloyds contactless limit uk

4 · lloyds contactless card not working

5 · lloyds bank contactless payment limit

6 · contactless payment limit per day

7 · can you withdraw money contactless

Step 1: Open the Shortcuts app > go to the Automation tab. Step 2: Tap New Automation or + (from the top-right corner). Step 3: Here, scroll down or search for NFC. Tap it. Step 4: Tap Scan. Hold .Learn how to use RFID NFC RC522 with ESP32, how to connect RFID-RC522 module to .

Since this feature was introduced in autumn 2021, 800,000 debit card customers . According to new data from Lloyds Bank* spend on debit cards made in person, .Contactless card. Make secure payments with your card wherever you see the contactless .Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, .

Furniture accounted for 77% of contactless payments, electrical 68% and . What is the contactless payment limit? The current contactless limit in the UK is .

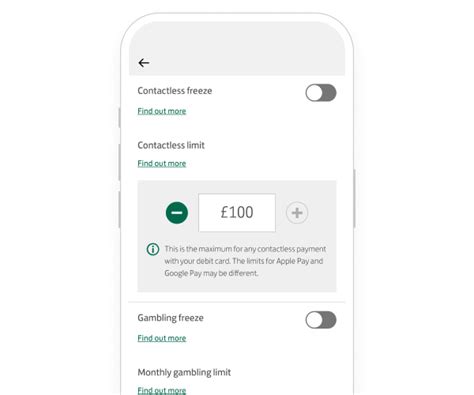

Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their .

The contactless payment limit, which is the amount you can spend on card without entering a PIN, will rise from £45 to £100 from 15 October, it's been confirmed. It comes after chancellor Rishi Sunak formally announced the .You cannot make a contactless payment of over £100 using your card. You will need to insert your card into the card reader and type in your PIN or complete a swipe transaction. Different limits may apply if you are using Apple or Google Pay. Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit. Over half (60%) of debit card customers who have set their own limit have opted for one under £50. According to new data from Lloyds Bank* spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic - the contactless limit was increased from £30 to .

Contactless card. Make secure payments with your card wherever you see the contactless symbol. Or add your card to your phone, to make paying even quicker. Paper-free statements. Get your statements delivered online instead of through your letter box. Tap-to-pay cards and mobile wallets provide contactless payment options that reduce the amount of contact required and have seen a major increase in popularity in recent years, especially as.Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases. Furniture accounted for 77% of contactless payments, electrical 68% and average retail came in at 87%. Lloyds was the first bank to allow customers to choose their own contactless limit for spending – between £30 and £95 – on a debit or credit card.

What is the contactless payment limit? The current contactless limit in the UK is £100. Initially, you could typically only authorise contactless payments of £30 and under. The limit was then increased to £45 at the start of the coronavirus pandemic.

Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their own contactless card limits from next month when the higher £100 cap comes into force. From 15 October, the contactless card limit will rise from £45 to £100. The contactless payment limit, which is the amount you can spend on card without entering a PIN, will rise from £45 to £100 from 15 October, it's been confirmed. It comes after chancellor Rishi Sunak formally announced the plans in the spring Budget.You cannot make a contactless payment of over £100 using your card. You will need to insert your card into the card reader and type in your PIN or complete a swipe transaction. Different limits may apply if you are using Apple or Google Pay. Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit. Over half (60%) of debit card customers who have set their own limit have opted for one under £50.

According to new data from Lloyds Bank* spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years. In April 2020 – during the pandemic - the contactless limit was increased from £30 to .Contactless card. Make secure payments with your card wherever you see the contactless symbol. Or add your card to your phone, to make paying even quicker. Paper-free statements. Get your statements delivered online instead of through your letter box. Tap-to-pay cards and mobile wallets provide contactless payment options that reduce the amount of contact required and have seen a major increase in popularity in recent years, especially as.Make everyday payments using Google Pay without the contactless card limit. It's safe, simple, and secure. Get benefits such as Everyday Offers on debit card and credit card purchases.

Furniture accounted for 77% of contactless payments, electrical 68% and average retail came in at 87%. Lloyds was the first bank to allow customers to choose their own contactless limit for spending – between £30 and £95 – on a debit or credit card. What is the contactless payment limit? The current contactless limit in the UK is £100. Initially, you could typically only authorise contactless payments of £30 and under. The limit was then increased to £45 at the start of the coronavirus pandemic.

Lloyds Bank, Halifax and Bank of Scotland customers will be able to set their own contactless card limits from next month when the higher £100 cap comes into force. From 15 October, the contactless card limit will rise from £45 to £100.

smart card eal

lloyds contactless payment limit uk

lloyds contactless payment limit

Fret not! As of April 2021, Chanel has launched a new method of authenticating its handbags and chain wallets. Gone are the serial stickers and matching authenticity cards you’ve been accustomed to for decades. Instead, .

contactless payment limit lloyds a credit card|can you withdraw money contactless